Title: Understanding CWBR (Continuous Wealth Building and Retirement)

Introduction to CWBR:

Continuous Wealth Building and Retirement (CWBR) is a strategic financial approach aimed at steadily accumulating wealth and securing a comfortable retirement through consistent, disciplined investment and savings practices. CWBR emphasizes longterm financial planning, diversification, and leveraging various investment vehicles to achieve financial independence and retirement goals.

Key Components of CWBR:

1.

Goal Setting:

CWBR begins with clearly defined financial goals, including retirement age, desired lifestyle in retirement, and target wealth accumulation. Setting specific, measurable, achievable, relevant, and timebound (SMART) goals is crucial to crafting an effective CWBR strategy.

2.

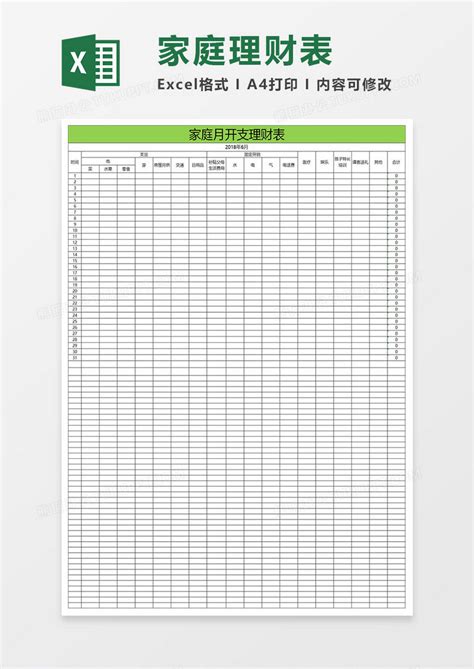

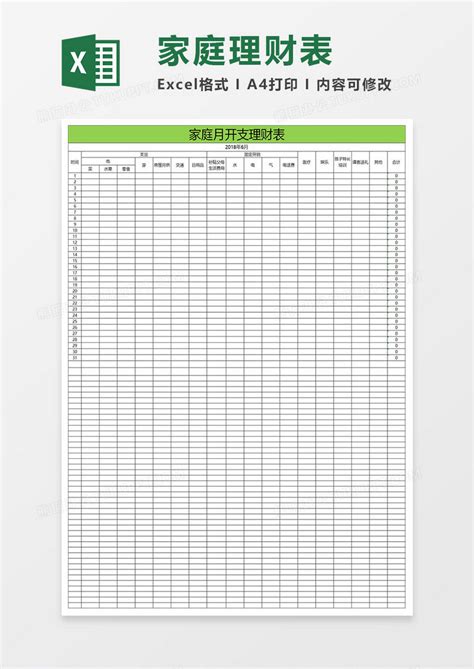

Budgeting and Saving:

CWBR advocates for disciplined budgeting and saving habits to ensure consistent contributions to investment accounts and retirement funds. By living below one's means and prioritizing saving, individuals can allocate more resources toward wealth accumulation and retirement planning.

3.

Asset Allocation:

Asset allocation is a fundamental aspect of CWBR, involving the strategic distribution of investment funds across various asset classes, such as stocks, bonds, real estate, and alternative investments. Diversification helps mitigate risk and optimize returns over the long term.

4.

Regular Investing:

CWBR emphasizes the importance of regular, systematic investing, whether through employersponsored retirement plans (e.g., 401(k) or 403(b)), individual retirement accounts (IRAs), or brokerage accounts. Consistent contributions, coupled with dollarcost averaging, enable investors to benefit from market fluctuations and compound interest.

5.

Tax Efficiency:

Minimizing tax liabilities is integral to CWBR. Utilizing taxadvantaged retirement accounts, implementing taxefficient investment strategies, and strategically timing withdrawals can optimize aftertax returns and preserve wealth during retirement.

6.

Risk Management:

While pursuing wealth accumulation, CWBR prioritizes risk management and downside protection. This includes maintaining an emergency fund, obtaining adequate insurance coverage, and periodically reviewing and adjusting investment portfolios based on changing market conditions and risk tolerance.

Advantages of CWBR:

1.

LongTerm Wealth Accumulation:

CWBR fosters a disciplined approach to wealth accumulation, allowing individuals to steadily build assets over time and achieve financial independence.

2.

Retirement Security:

By prioritizing retirement planning and consistently saving and investing for the future, CWBR helps individuals secure a comfortable retirement and enjoy financial freedom in their later years.

3.

Flexibility and Adaptability:

CWBR can be tailored to individuals' unique financial situations, goals, and risk tolerances. It allows for adjustments and course corrections as circumstances change, ensuring continued progress toward longterm objectives.

4.

Peace of Mind:

Adopting CWBR instills financial discipline and confidence, providing peace of mind knowing that one is proactively planning for the future and taking steps to achieve financial security and independence.

Conclusion:

Continuous Wealth Building and Retirement (CWBR) offers a comprehensive framework for achieving longterm financial goals, including wealth accumulation and retirement security. By emphasizing disciplined saving, strategic investing, risk management, and tax efficiency, CWBR empowers individuals to chart a path toward financial independence and a comfortable retirement lifestyle.

Whether you're just starting your career or nearing retirement age, embracing the principles of CWBR can help you take control of your financial future and build lasting wealth for yourself and your loved ones. Start today and embark on the journey toward a more secure and prosperous tomorrow.

Note:

CWBR is a conceptual framework, and individuals should consult with financial professionals to tailor strategies to their specific circumstances and objectives.