Title: Developing Purchase Indicators for Internet Funds

Investing in internet funds requires a careful consideration of various factors to make informed decisions. While there isn't a onesizefitsall formula for determining when to buy into internet funds, you can develop indicators based on key metrics and market analysis. Here's a suggested framework for creating purchase indicators:

1. Growth Metrics:

Revenue Growth:

Look for internet funds that invest in companies with consistent and robust revenue growth. Analyze historical revenue data and project future growth trajectories.

User Base Expansion:

Monitor the user base of prominent internet companies held within the fund. Increasing user numbers suggest a growing market and potential for higher revenues.

Market Share:

Evaluate the fund's holdings in terms of market share within their respective industries. Higher market share indicates dominance and potential for sustained growth.

2. Profitability Indicators:

Profit Margins:

Assess the profitability of the fund's underlying companies by examining their profit margins. Consistent or improving margins demonstrate efficient operations and competitive strength.

Earnings Growth:

Look for internet companies with strong earnings growth over time. Positive earnings growth indicates that the company is generating profits and reinvesting them for further expansion.

3. Valuation Metrics:

PricetoEarnings (P/E) Ratio:

Compare the P/E ratios of the fund's holdings to industry averages and historical benchmarks. Lower P/E ratios may suggest undervaluation, while higher ratios could indicate overvaluation.

PricetoSales (P/S) Ratio:

Evaluate the P/S ratios of individual companies within the fund. A lower P/S ratio relative to peers may indicate a potential buying opportunity.

Discount to Intrinsic Value:

Assess whether the fund's current market price is trading at a discount to its intrinsic value based on fundamental analysis.

4. Market Sentiment and Trends:

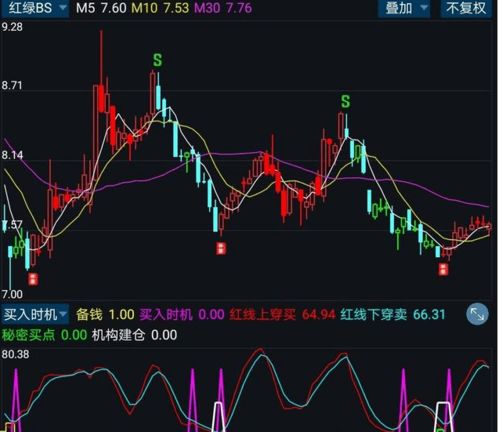

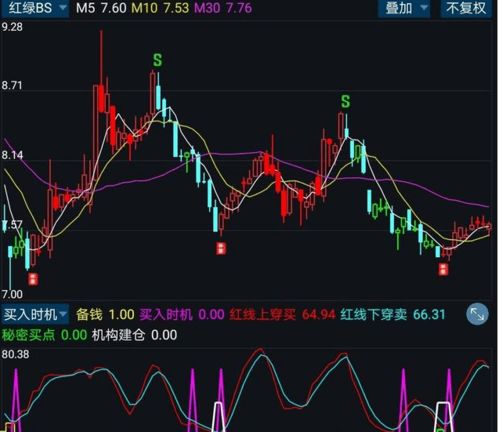

Technical Analysis:

Use technical indicators such as moving averages, relative strength index (RSI), and MACD to gauge market sentiment and identify potential entry points.

News and Events:

Stay informed about industry news, regulatory developments, and companyspecific events that could impact the performance of internet stocks.

5. Risk Management:

Diversification:

Ensure that the internet fund is welldiversified across companies, sectors, and geographic regions to mitigate risk.

Volatility Analysis:

Assess the historical volatility of the fund and its underlying holdings to gauge the level of risk and potential for price fluctuations.

6. LongTerm Fundamentals:

Industry Trends:

Consider longterm trends and developments in the internet sector, such as the rise of ecommerce, cloud computing, and digital advertising.

Disruptive Technologies:

Evaluate the fund's exposure to emerging technologies and innovative business models that have the potential to reshape the internet landscape.

Conclusion:

Developing effective purchase indicators for internet funds involves a combination of quantitative analysis, qualitative assessment, and market intuition. It's essential to continuously monitor the performance of the fund and adjust your investment strategy accordingly based on evolving market conditions and new information.

Remember to consult with financial professionals or conduct thorough research before making any investment decisions. Building a diversified portfolio tailored to your investment goals and risk tolerance is key to longterm success in the dynamic and everchanging internet industry.